This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

My Service

1

Build a deep understanding of the commercial drivers behind your company.

2

Design and develop suite of Management packages that best represent your financial as well as operational performance.

3

Planning (3 or 5-year), Annual budgeting, quarterly forecasting, monthly management reporting and A. N Other FP&A reporting.

4

Building complex, but user-friendly, financial models that analyse to help support your business decision making.

5

Constructively challenge your assumptions and drive improved business performance.

6

Prepare your board presentations.

7

Construct a new suite of KPIs to monitor your business performance as relevant to your industry.

8

Critically analyse performance versus budget whilst investigating variances and developing new and improved forecasting tools.

Your reason:

This may be due to seeking to raise new rounds of equity or new debt or existing debt restructuring.

Your opportunity:

You do not need a dedicated Management Accountant anymore = Saving in salaries and NIC.

You do not need a dedicated financial modeler + Analyst + Manager + Director = Savings.

Goal #3: You do not need to spend on new software or tech, we use the most common tools = Savings.

Check out some of our sample reports

Management Accounts

Management Board Package

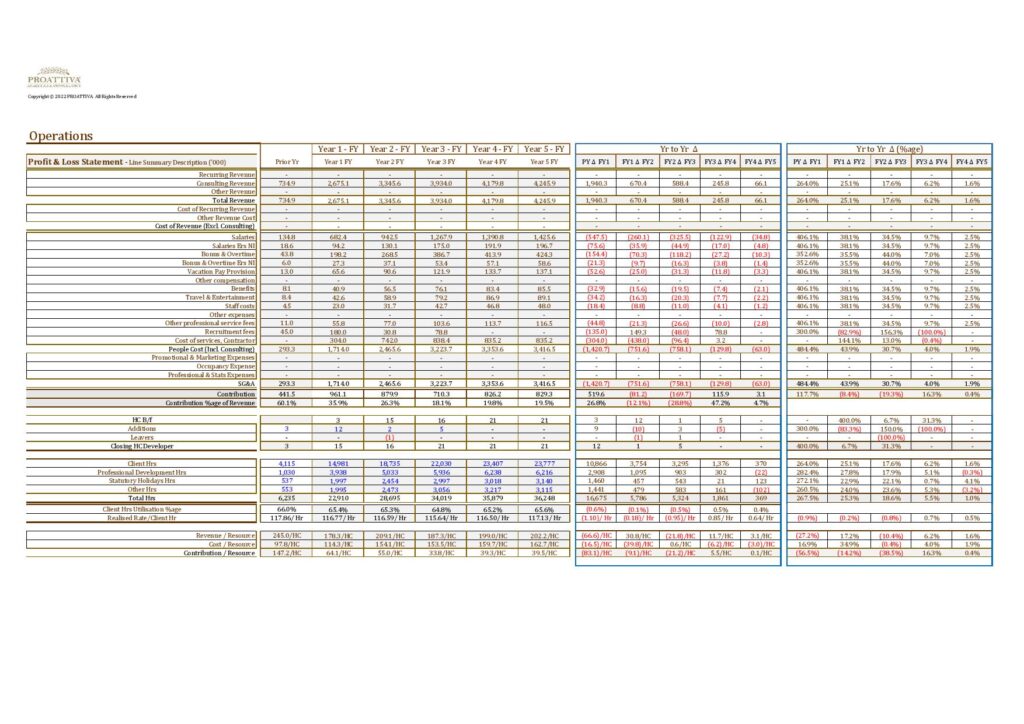

- What: Management accounting package is the report that gathers sets of financial and operational data into a relevant set of informative reports that support management across the various levels of the business in the day-to-day running the company.

- Why: The sole objective is to facilitate management teams and all stakeholders with decision-backed supporting information.

- Frequency: Monthly

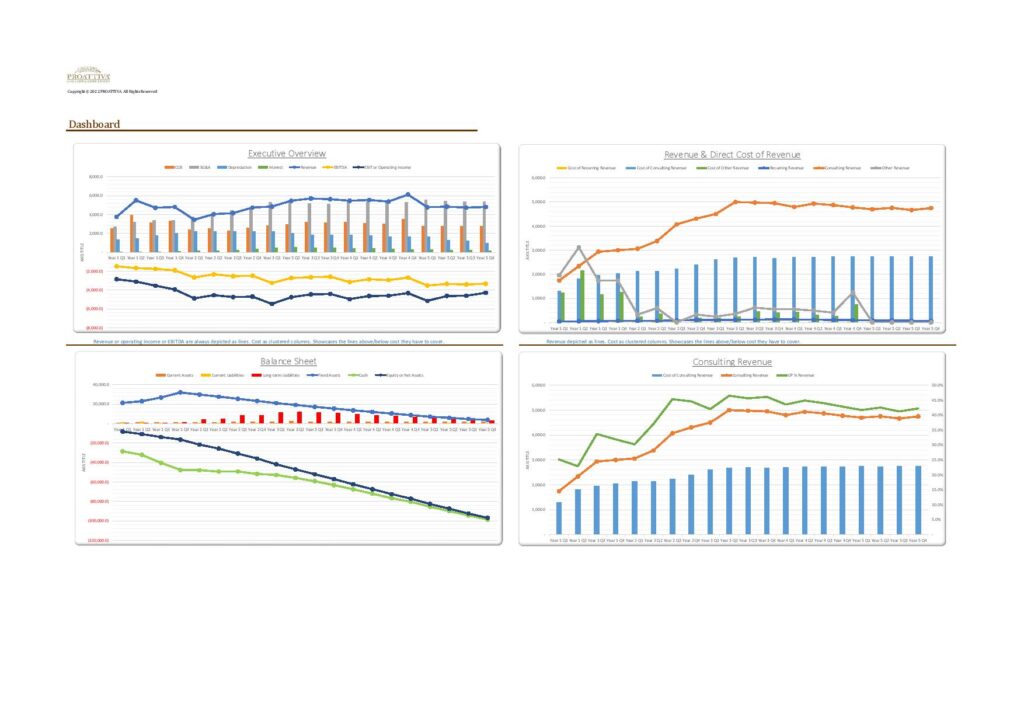

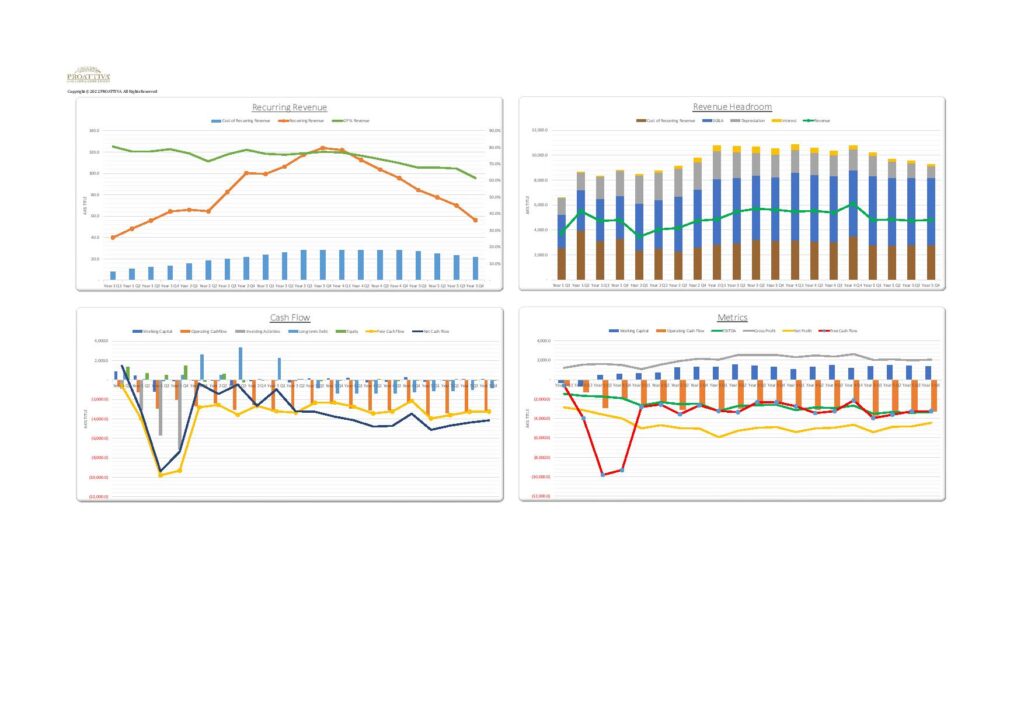

- Contents: Profit & Loss, Balance Sheet, Cashflow Statement, Each Departmental P&L, Customer Revenue Trend, Suppliers Cost of Sales Trend, SG&A and Overheads Drivers Trend Report), KPI (Debt Ratio, Current Ratio, CAC, Churn Rate, Cash Runway etc.)

Planning, Budgeting and Reforecasting

Uses “Bottom-Up” approach

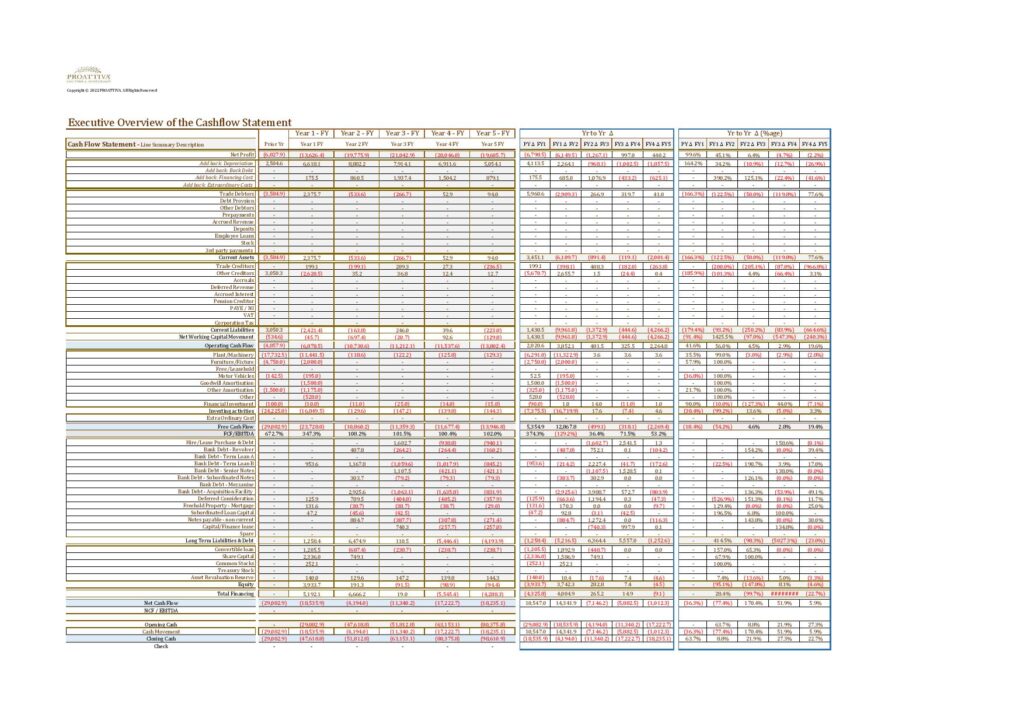

- What: Excel-based simulation tool that gives a projection of revenue, cost of revenue, overheads, assets, liabilities, equity, cash from operating activities, cash from financing activities, cash from financing activities and industry relevant key performance indicators.

- Why: Projection report of where the company sees itself based on micro and macro-economic outlook. Frequency: Annually, however, updated for quarterly forecast. Enhanced as at when necessary.

- Frequency: Annually, however, updated for quarterly forecast. Enhanced as at when necessary.

- Contents: Segregated into input, processing and output. Input: perm staff planning model, temp staff planning model, recurring revenue planning model, cashbook planning model, capex planning model, expenditure planning model.

Financial Modelling

- What: Excel-based simulation tool that gives a projection of revenue, cost of revenue, overheads, assets, liabilities, equity, cash from operating activities, cash from financing activities, cash from financing activities and industry relevant key performance indicators.

- Why: Elimination of guesstimates of past, current and future decisions financial and operational outcomes.

- Frequency: Annually, however, updated for quarterly forecast. Enhanced as at when necessary.

- Contents: Segregated into input, processing and output. Input: perm staff planning model, temp staff planning model, recurring revenue planning model, cashbook planning model, capex planning model, expenditure planning model.

Directorship of FP&A

Using Hands-on approach

- What: Own the entire FP&A process and all the functional activities.

- Why: Outline the monthly management, quarterly reforecasting, annual budget and 3–5-year plan.

- Frequency: Monthly, quarterly, annually and as at when required.

- Contents: Financial modelling, processing and output. Input: perm staff planning model, temp staff planning model, recurring revenue planning model, cashbook planning model, capex planning model, expenditure planning model. o Output: principal financial statements of the P&L, Balance Sheet and Cashflow Statement, headcount by departments, ARPU by streams, dashboard.

We work from everywhere with anyone at anywhere

Contact us

- info@proattivaanalyticsconsultancy.com